Accounting software has become indispensable for small businesses, freelancers, and accountants aiming to streamline financial management, invoicing, and tax compliance. With the global financial management software market projected to reach $24.4 billion by 2026 (Capterra), choosing the right accounting tool is critical for business growth.

This Blog guide evaluates top platforms like QuickBooks Online, Xero, FreshBooks, and Zoho Books, based on features, pricing, user feedback, and Making Tax Digital (MTD) compliance for 2026 (NerdWallet). Optimized for SEO, it incorporates keyword research strategies (per your July 28, 2025 interest) to help you find the best accounting software for your small business or freelancing needs.

Why Use Accounting Software in 2025?

Accounting software automates financial tasks like invoicing, expense tracking, payroll, and financial reporting, reducing errors and saving time (Business News Daily). Here’s why it’s essential in 2025:

- Automation: Eliminates manual data entry and bookkeeping errors.

- Scalability: Grows with your business needs, from sole traders to SMBs .

- MTD Compliance: Supports HMRC’s Making Tax Digital requirements for 2026 .

- Real-Time Insights: Provides financial dashboards for cash flow and profitability.

- Accessibility: Cloud-based platforms enable mobile access and remote collaboration.

This accounting software review compares top tools based on ease of use, features, pricing, and user reviews to help small business owners and freelancers make informed decisions.

Tip: Target long-tail keywords like best accounting software for small business 2025 to boost SERP rankings.

Top 8 Accounting Software Solutions for 2025

Below is a detailed review of the best accounting software for small businesses, freelancers, and accountants, with features, pricing, pros, cons, and use cases.

1. QuickBooks Online (Intuit)

QuickBooks Online is the #1 accounting software for small businesses, offering robust features and HMRC-recognized MTD compliance (TechRadar).

- Key Features:

- AI-powered automation for invoicing, expense tracking, and bank reconciliation (QuickBooks).

- 750+ integrations with PayPal, Shopify, and CRM systems .

- Financial reporting with profit and loss, balance sheet, and cash flow statements.

- Mobile app for on-the-go bookkeeping .

- Pricing:

- Simple Start: $20/month.

- Essentials: $50/month.

- Plus: $70/month.

- Advanced: $150/month .

- 50% off for 3 months .

- Pros:

- Intuitive interface for non-accountants.

- Comprehensive financial reporting and integrations .

- MTD-compliant for VAT returns .

- Cons:

- Limited users in lower plans.

- Higher cost for advanced features

- Best For: SMBs and accountants needing all-in-one accounting

- Example: A small retail business uses QuickBooks to automate inventory tracking and invoicing for eCommerce (QuickBooks).

- User Feedback: “QuickBooks’s cloud-based environment makes it ideal for remote teams”

Keyword Tip: Optimize for QuickBooks Online for small business to attract SMB owners.

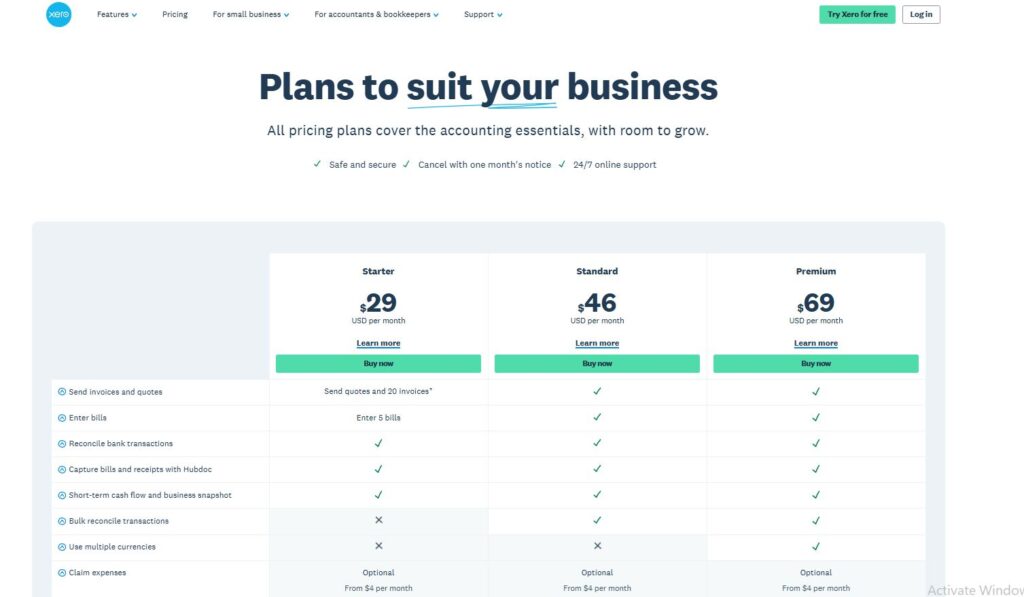

2. Xero

Xero is a cloud-based accounting software known for its ease of use and extra features like project tracking.

- Key Features:

- Advanced invoice templates customizable in Microsoft Word

- Bank feeds for real-time transaction syncing

- MTD-compliant for VAT returns and quarterly filings

- Expense and project tracking for freelancers

- Pricing:

- Early: $16/month (limited to 5 invoices).

- Growing: $42/month.

- Established: $59/month

- 90% off for 6 months until March 2026

- Pros:

- User-friendly dashboard for multiple users

- Scalable plans for growing businesses

- Free 30-day trial

- Cons:

- Limited invoices in Early plan

- No phone support in lower tiers

- Best For: Freelancers and SMBs needing extra features

- Example: A freelancer uses Xero to track project expenses and send custom invoices

- User Feedback: “Xero’s invoice customization is a game-changer for branding”

Keyword Tip: Target Xero for freelancers to attract sole traders.

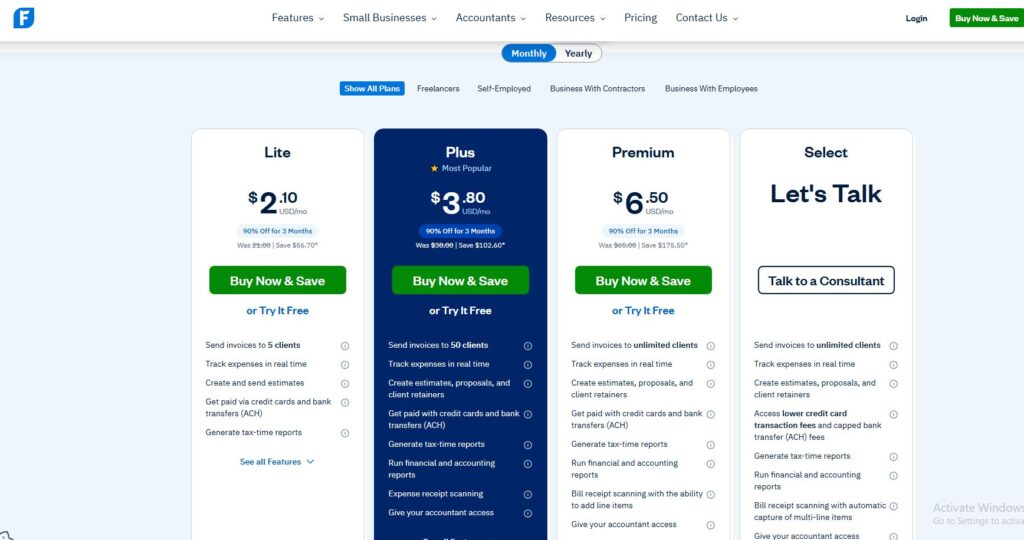

3. FreshBooks

FreshBooks is a cloud-based accounting software designed for freelancers and service-based businesses

- Key Features:

- Double-entry accounting with time tracking and expense management

- Customizable invoices with online payment options

- Mobile app with receipt scanning

- Client portal for real-time collaboration

- Pricing:

- Lite: $6.30/month (billed annually).

- Plus: $20/month.

- Premium: $50/month

- 30-day free trial

- Pros:

- User-friendly for non-accountants

- Affordable for freelancers

- Strong mobile app functionality

- Cons:

- Limited inventory management

- No quarterly tax estimates

- Best For: Freelancers and service-based businesses

- Example: A digital marketing freelancer uses FreshBooks to send professional invoices and track project hours

- User Feedback: “FreshBooks is perfect for freelancers who need simple invoicing”

Tip: Use FreshBooks for freelancers to target service-based professionals.

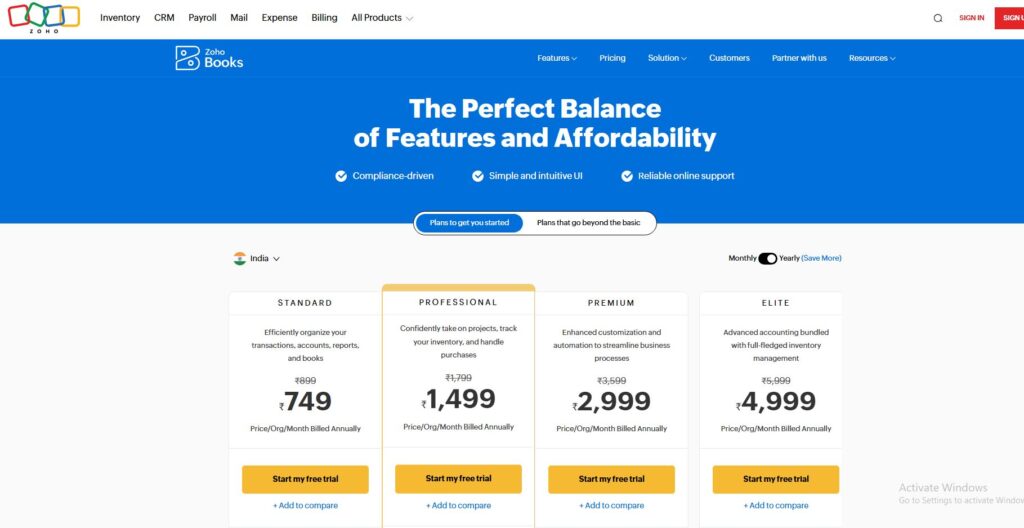

4. Zoho Books

Zoho Books offers a feature-packed free plan and scalable solutions for small businesses

- Key Features:

- AI-driven automation for transaction categorization and anomaly detection

- Inventory management for multiple warehouses

- Client portal and customizable invoices

- MTD-compliant for VAT returns

- Pricing:

- Free plan for businesses with <$50k revenue.

- Standard: $20/month.

- Professional: $50/month

- Pros:

- Free plan for startups

- Integrates with Zoho suite

- Scalable for growing businesses

- Cons:

- Additional users cost $2 each

- Fewer third-party integrations than QuickBooks

- Best For: Startups and small businesses on a budget

- Example: A small eCommerce business uses Zoho Books to manage inventory and invoices

- User Feedback: “Zoho Books is affordable and easy to scale”

Tip: Optimize for Zoho Books for startups to attract budget-conscious businesses.

5. FreeAgent

FreeAgent is tailored for freelancers and small businesses, with free access via NatWest or Mettle accounts

- Key Features:

- MTD-compliant for VAT returns and quarterly filings

- Mobile app with receipt scanning and expense tracking

- Payroll and cash flow projections

- Multi-currency support for international clients

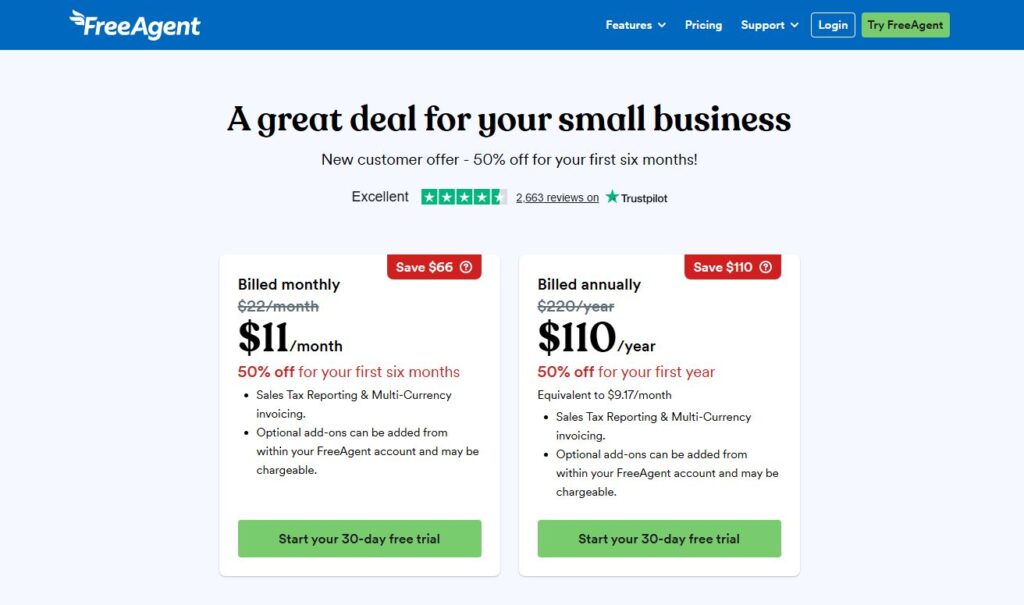

- Pricing:

- Free with NatWest, RBS, Ulster Bank, or Mettle accounts.

- Standard: $24/month

- 30-day free trial

- Pros:

- Free for eligible bank account holders

- User-friendly for sole traders

- Strong mobile app

- Cons:

- Limited advanced features for larger businesses

- Add-ons like Amazon integration cost extra

- Best For: Freelancers and sole traders

- Example: A freelancer uses FreeAgent to upload receipts and file VAT returns

- User Feedback: “FreeAgent saves time on VAT returns”

Tip: Target FreeAgent for freelancers to attract sole traders.

6. Sage Accounting

Sage Accounting offers clear pricing and multi-user support for small businesses

- Key Features:

- AI-powered automation for invoicing and expense tracking

- MTD-compliant for HMRC filings

- Integration with payment processors and CRM systems

- Mobile app for on-the-go bookkeeping

- Pricing:

- Start: $18/month.

- Standard: $36/month.

- Plus: $59/month

- 3 months free

- Pros:

- Transparent pricing

- Scalable for multi-user teams

- Strong customer support

- Cons:

- Basic plans lack quotes and cash flow forecasts

- Less intuitive than QuickBooks

- Best For: SMBs with multiple users

- Example: A consulting firm uses Sage to manage team expenses and invoices

- User Feedback: “Sage’s reporting is robust but takes time to learn”

Tip: Use Sage Accounting for SMBs to target multi-user businesses.

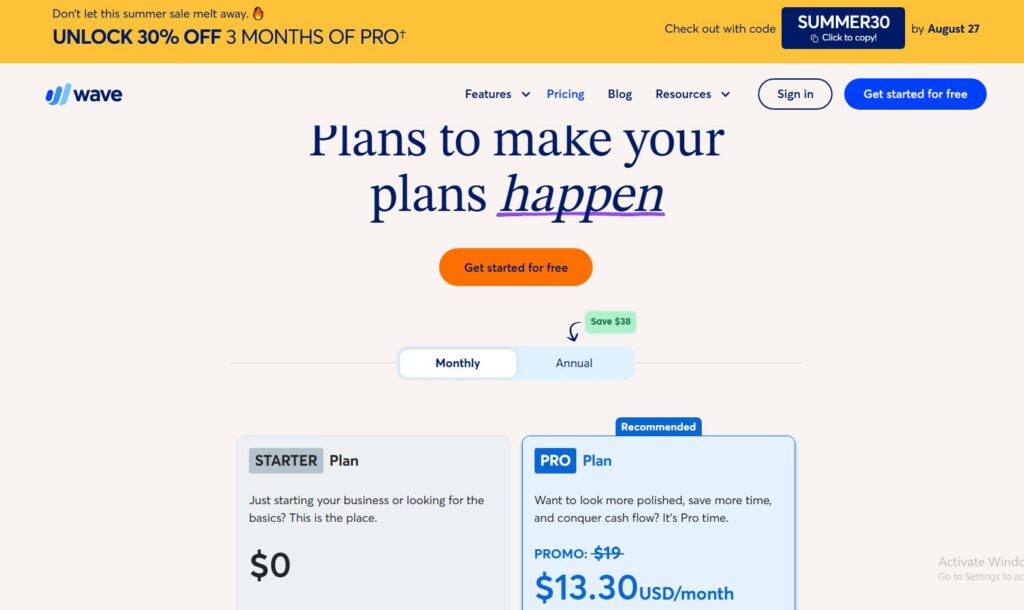

7. Wave

Wave is a free accounting software ideal for freelancers and startups with basic needs (Reddit).

- Key Features:

- Invoicing and expense tracking with receipt scanning

- Bank reconciliation for real-time tracking

- Multi-currency support for international clients

- Pricing:

- Free for basic accounting and invoicing.

- Pro: $16/month for payroll and payment processing

- Pros:

- Free plan for startups

- User-friendly for non-accountants

- Mobile app for receipt uploads

- Cons:

- Limited advanced features (Reddit).

- Payroll costs extra

- Best For: Freelancers and startups on a budget (Reddit).

- Example: A freelancer uses Wave to send invoices and track expenses for free

- User Feedback: “Wave is basic but great for freelancers” (Reddit).

Tip: Optimize for Wave for freelancers to attract budget-conscious users.

8. Oracle NetSuite

Oracle NetSuite is a cloud-based ERP with advanced accounting features for mid-sized businesses

- Key Features:

- Comprehensive financial management with general ledger and payroll

- Real-time reporting and dashboards

- Integration with CRM and eCommerce platforms

- AI-driven anomaly detection

- Pricing:

- Custom pricing based on business needs

- Pros:

- Scalable for mid-sized businesses

- Robust integrations with business systems

- Real-time financial insights

- Cons:

- High cost for small businesses

- Complex interface for beginners

- Best For: Mid-sized businesses needing ERP solutions

- Example: A manufacturing firm uses NetSuite for inventory and financial reporting

- User Feedback: “NetSuite is powerful but expensive”

Tip: Target NetSuite for mid-sized businesses to attract enterprise users.

How to Choose the Best Accounting Software

Selecting the best accounting software depends on your business needs, budget, and technical expertise. Consider these factors

- Business Size: Freelancers need simple tools ; SMBs need scalability

- Features: Prioritize invoicing, expense tracking, payroll, or inventory management

- MTD Compliance: Ensure HMRC compatibility for VAT returns

- Budget: Free plans (Wave, Zoho Books) vs. premium options

- Ease of Use: FreshBooks and Wave for non-accountants; Sage for advanced users

- Integrations: Look for PayPal, Shopify, or CRM compatibility

Example: A cooking blog owner (per your previous requests) might choose FreshBooks for invoicing and expense tracking while blogging.

Tip: Use how to choose accounting software to target business owners.

Using Accounting Software for Small Businesses and Freelancers

Accounting software streamlines financial management for small businesses and freelancers. Here’s how to leverage it,

1. Invoicing

Automate professional invoices with payment reminders

- Best Tools: QuickBooks, FreshBooks, Xero

- Tip: Use customizable invoice templates for branding

Tip: Target accounting software for invoicing to attract freelancers.

2. Expense Tracking

Track business expenses with receipt scanning and bank feeds

- Best Tools: FreshBooks, FreeAgent, Zoho Books

- Tip: Categorize expenses for tax deductions

Tip: Optimize for expense tracking software for small businesses.

3. Tax Compliance

Ensure MTD compliance for VAT returns and quarterly filings.

- Best Tools: QuickBooks, Xero, FreeAgent

- Tip: Integrate with HMRC for seamless tax filing

Tip: Use MTD-compliant accounting software to target UK businesses.

4. Financial Reporting

Generate profit and loss, balance sheets, and cash flow statements

- Best Tools: QuickBooks, NetSuite, Sage

- Tip: Use visual dashboards for financial insights

Tip: Target financial reporting software for accountants.

5. Payroll Management

Automate payslips and RTI submissions to HMRC

- Best Tools: QuickBooks, Xero, FreeAgent

- Tip: Check payroll add-on costs

Tip: Optimize for payroll accounting software to attract SMBs.

Best Practices for Using Accounting Software

- Set Up Bank Feeds: Connect bank accounts for real-time syncing

- Use Mobile Apps: Upload receipts and manage invoices on the go

- Leverage Integrations: Sync with PayPal, Shopify, or CRM systems

- Regular Backups: Export data to avoid data loss

- Train Staff: Use free trials to learn features

Tip: Share accounting software tips to engage small business owners.

Pros and Cons of Accounting Software

Pros

- Automation reduces bookkeeping errors

- Cloud-based access for remote teams

- MTD compliance for HMRC filings

- Scalable plans for business growth

- Real-time financial insights

Cons

- Learning curve for advanced tools like NetSuite

- Subscription costs can be high

- Limited features in free plans (Reddit).

- Data security concerns with cloud-based software

Tip: Highlight pros of accounting software to attract business owners.

Success Stories with Accounting Software

- Edelweiss Bakery: Used QuickBooks to streamline invoicing, boosting efficiency by 40%

- Freelancer Testimonial: FreeAgent saved hours on VAT returns for a graphic designer

- Small Retail Business: Zoho Books improved inventory tracking, increasing profit margins

Tip: Include accounting software success stories to inspire SMBs.

Tips for Maximizing Accounting Software

- Start with a Free Trial: Test QuickBooks or Xero for 30 days

- Customize Dashboards: Display key financial metrics

- Automate Recurring Tasks: Set up recurring invoices and payment reminders

- Integrate with Other Tools: Sync with PayPal or Shopify

- Stay MTD-Compliant: Use HMRC-recognized software

- Learn Features: Take QuickBooks Online Accountant courses

Tip: Use accounting software tips to engage freelancers.

Common Mistakes to Avoid

- Ignoring MTD Requirements: Ensure HMRC compliance

- Skipping Training: Learn features via tutorials

- Not Backing Up Data: Export financial data regularly

- Choosing Oversized Software: Avoid NetSuite for small businesses

- Overlooking Costs: Budget for add-ons and user fees

Tip: Address accounting software mistakes to help beginners.

Accounting Software vs. Spreadsheets

- Spreadsheets: Cheap but prone to errors and time-consuming

- Accounting Software: Automates bookkeeping, ensures MTD compliance, and provides real-time insights

Recommendation: Switch to cloud-based accounting software like QuickBooks or Wave for efficiency

Tip: Target accounting software vs spreadsheets to attract startups.

Conclusion: Which Accounting Software Should You Choose?

In 2025, QuickBooks Online is the best accounting software for SMBs needing all-in-one solutions. Xero suits freelancers and SMBs with extra features, while FreshBooks is ideal for service-based businesses. Zoho Books and Wave offer budget-friendly options for startups, and FreeAgent is perfect for freelancers with bank partnerships. Sage Accounting supports multi-user teams, and NetSuite caters to mid-sized businesses. Evaluate your business size, budget, and MTD compliance needs. Start with a free trial at quickbooks.intuit.com or xero.com to test features .

Tip: Target best accounting software 2025 to attract business owners.

Pingback: 62+ Bad Boy Captions For Instagram | Caption Hype